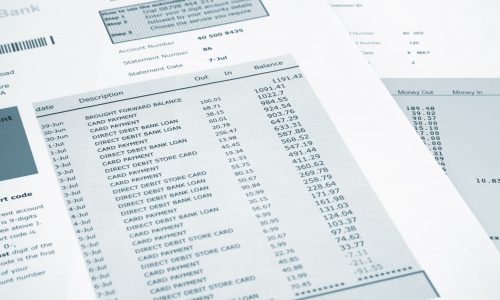

To put it simply, most of the work done by your bookkeeper revolves around explaining money movements in your bank accounts. Sure, they do other fancy stuff, like processing payroll, posting accruals, and making all sorts of abracadabra entries. But the biggest job is to decipher the cash movements into meaningful records. When someone looks at your bank statements, all they probably see is funds coming in and funds going out. The same with credit card statements.

The bookkeeper’s goal is to categorize all these amounts into proper accounts. So that overtime, when you forget where these thousand grands came from or why you spent those hundred dollars, it’s all well explained and recorded in one place – bookkeeping records. For yourself, for the taxman, and, perhaps, for your lenders.

How do you ensure that your bookkeeping records capture all the money movements and nothing is left out and forgotten? You look at “bank reconciliation”. This is something that your bookkeeper is supposed to prepare monthly for all of your business bank accounts and credit cards.

Here is how you can perform the check:

a) Ask your bookkeeper to show you where to find bank reconciliation reports for previous month.

b) Verify that the bank reconciliation report was prepared for each and every bank and credit card account that your business uses. If the report is missing for any account, ask your bookkeeper for the reason.

c) Look for the date of the bank and credit card statement used on each bank reconciliation report. That date should fall within the latest month that was completed by the bookkeeper.

d) Bank reconciliation report that for whatever reason is missing should be done for all bank and credit card accounts.

Performing the above steps will help you check the following about your bookkeeping records:

- if they include all the money coming in and going out of your bank accounts and credit cards; and

- if they are maintained up to date to match the recent bank and credit card statements.

The above basic steps are just a high-level verification that you can do without acquiring any specific accounting knowledge. If you want to dig deeper into your bookkeeping records, you can always ask your bookkeeper or accountant for help.